Analyzing the integration of Organization of Islamic Cooperation (OIC) countries before and during Rusian-Ukraine war

Abstract

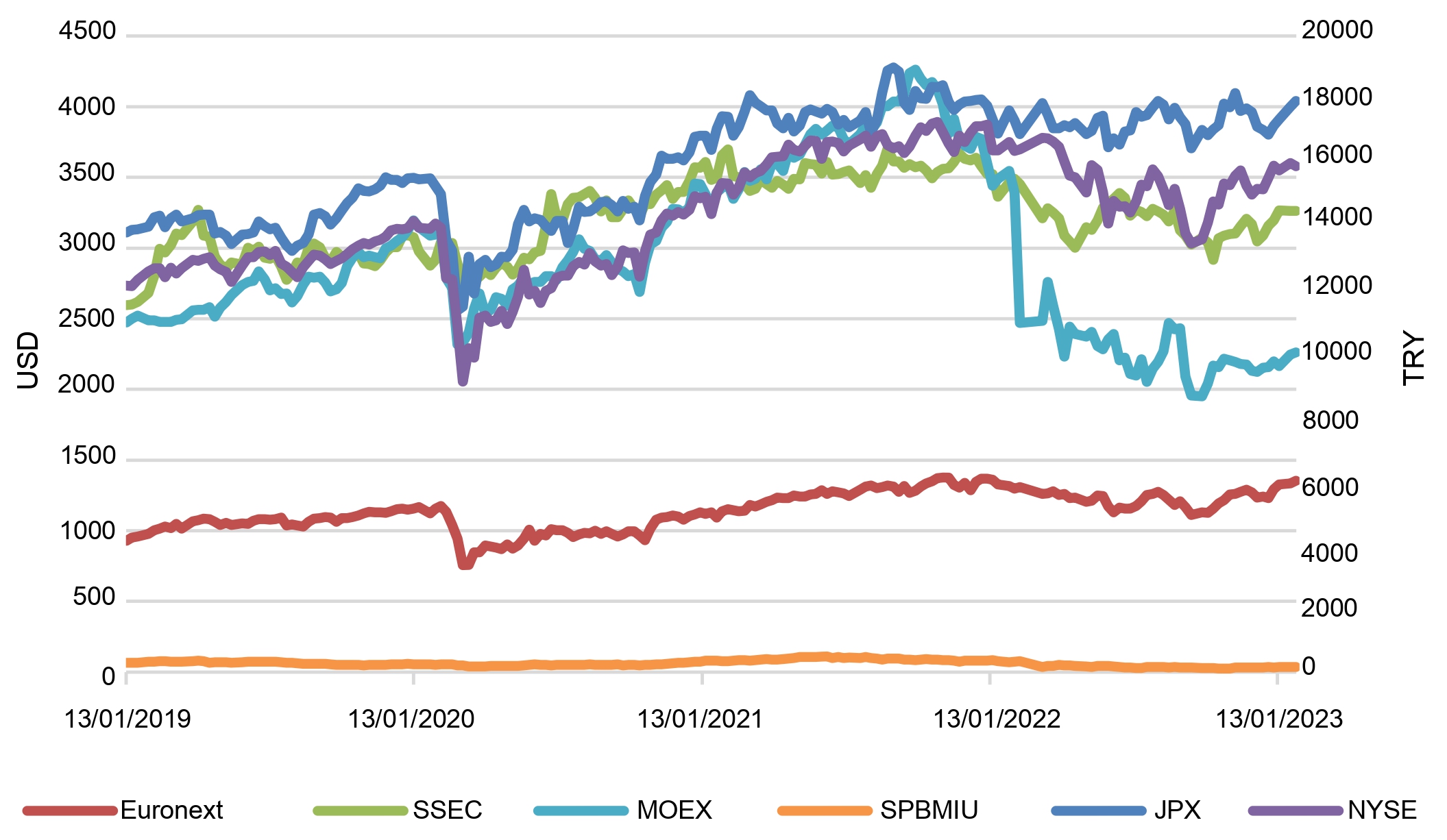

Co-movement of integrated stock market is causing economic shocks and global crises. A typical example of this crisis was the Russia-Ukraine war in 2022, which impacted the stock market. Therefore, this research aimed to examine the development, integration, and response of the five Islamic stock market in Organization of Islamic Cooperation (OIC) countries during the Russia-Ukraine war. Vector Autoregressive/Vector Error Correction Model (VAR/VECM) was used to analyze DJIMMT25, SPSADS, SPSUUAEDS, JII, DJIMT, SPBMIR, and SPBMIU indices. The results showed that the United Arab Emirates (UAE) and Saudi Arabia stock market had the same movement, while Turkey experienced a positive trend during the war. The Islamic stock market was also cointegrated but Malaysia influenced the other four OIC countries. Meanwhile, IRF reported a permanent effect on the volatility of the market due to the shocks experienced. The volatility response was relatively small since the stock market dominated the contribution of shocks.

References

Abbes MB, Trichilli Y. Islamic stock markets and potential diversification benefits. Borsa Istanbul Review. 2015;15(2):93-105. https://doi.org/10.1016/j.bir.2015.03.001

Adam P, Nusantara AW, Muthalib AA. Foreign Interest Rates and the Islamic Stock Market Integration between Indonesia and Malaysia. Iranian Economic Review. 2017;21(3):639-659.

Al-Khazali O, Lean HH, Samet A. Do Islamic stock indexes outperform conventional stock indexes? A stochastic dominance approach. Pacific-Basin Finance Journal. 2014;28(1):29-46. https://doi.org/10.1016/j.pacfin.2013.09.003

Almohamad S, Mishra AV, Yu X. Mena Stock Markets Integration: Pre and Post Global Financial Crisis. Australian Economic Papers. 2018;57(2):107-141. https://doi.org/10.1111/1467-8454.12106

Arshad S, Rizvi SAR. An Empirical Study of Islamic Equity as a Better Alternative during Crisis Using Multivariate GARCH DCC. Islamic Economic Studies. 2014;22(1):159-184. https://doi.org/10.12816/0004134

Baur DG, Lucey BM. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financial Review. 2010;45(2):217-229. https://doi.org/10.1111/j.1540-6288.2010.00244.x

Bekaert G, Harvey CR. Emerging equity market volatility. Journal of Financial Economics. 1997;43(1):29-77. https://doi.org/10.1016/S0304-405X(96)00889-6

Chen G, Firth M, Meng Rui O. Stock market linkages: Evidence from Latin America. Journal of Banking & Finance. 2002;26(6):1113-1141. https://doi.org/10.1016/S0378-4266(01)00160-1

Chowdhury MAF, Abdullah M, Masih M. Risk Spillover of Russia-Ukraine War and Oil Price on Asian Islamic Stocks and Cryptocurrency: A Quantile Connectedness Approach. Asian Economics Letters. 2023;4(4). https://doi.org/10.46557/001c.74920

Cifuentes-Faura J. Economic consequences of the Russia-Ukraine war: a brief overview. Espaço e Economia. 2022. https://doi.org/10.4000/espacoeconomia.21807

Darmarmadji T, Fakhruddin HM. Pasar Modal di Indonesia. Salemba Empat. 2011.

De Long JB, Shleifer A, Summers LH, Waldmann RJ. Noise Trader Risk in Financial Market. Journal of Political Economy. 1990;98(4):703-738. https://doi.org/10.1086/261703

Dewandaru G, Rizvi SAR, Masih R, Masih M, Alhabshi SO. Stock market co-movements: Islamic versus conventional equity indices with multi-timescales analysis. Economic Systems. 2014;38(4):553-571. https://doi.org/10.1016/j.ecosys.2014.05.003

Endri. Integrasi Pasar Saham Kawasan Perdagangan Bebas Asean - China. Integritas. 2009;2(2):121-139.

Engle RF, Granger CWJ. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica. 1987;55(2):251. https://doi.org/10.2307/1913236

Fama EF. Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance. 1970;25(2):383. https://doi.org/10.2307/2325486

Fama EF, Fisher L, Jensen MC, Roll R. The Adjustment of Stock Prices to New Information. International Economic Review. 1969;10(1):1. https://doi.org/10.2307/2525569

Firdaus M. Aplikasi Ekonometrika untuk data panel dan time series. 2011. IPB Press.

Hassan MK, Girard E. Faith-Based Ethical Investing: The Case of Dow Jones Islamic Indexes. Islamic Economic Studies. 2010;17(2). https://doi.org/10.2139/ssrn.1808853

Haugen R. Modern Investment Theory (5th Edition). 2001. Pearson.

Janakiramanan S, Lamba AS. An empirical examination of linkages between Pacific-Basin stock markets. Journal of International Financial Markets, Institutions and Money. 1998;8(2):155-173. https://doi.org/10.1016/S1042-4431(98)00029-8

Khudaykulova M, Yuanqiong H, Khudaykulov A. Economic Consequences and Implications of the Ukraine-Russia War. The International Journal Of Management Science And Business Administration. 2022;8(4):44-52. https://doi.org/10.18775/ijmsba.1849-5664-5419.2014.84.1005

Kurniawan A. Negara ini Ketiban Untung saat Perang Rusia-Ukraina. 2022. Sindonews.

Lütkepohl H. New Introduction to Multiple Time Series Analysis. 2005. https://doi.org/10.1007/978-3-540-27752-1

Markowitz H. Portfolio Selection. The Journal of Finance. 1952;7(1):77-91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

Masteikiene R, Venckuviene V. Changes of Economic Globalization Impacts on the Baltic States Business Environments. Procedia Economics and Finance. 2015;26:1086-1094. https://doi.org/10.1016/S2212-5671(15)00934-X

Musrizal. Integrasi Pasar Saham Indonesia, Jepang dan India. LENTERA. 2013;13(4).

Nomran NM, Haron R. The impact of COVID-19 pandemic on Islamic versus conventional stock markets: international evidence from financial markets. Future Business Journal. 2021;7(1):1-16. https://doi.org/10.1186/s43093-021-00078-5

Ntim CG, English J, Nwachukwu J, Wang Y. On the efficiency of the global gold markets. International Review of Financial Analysis. 2015;41:218-236. https://doi.org/10.1016/j.irfa.2015.03.013

Orhan E. The Effect of the Russia-Ukraine War on Global Trade. In Journal of International Trade. Logistics and Law. 2022;8(1):141-146.

Royfaizal RC, Lee C, Azali M. ASEAN-5 + 3 and US Stock Markets Interdependence Before, During and After Asian Financial Crisis. 2009. https://doi.org/10.5539/ijef.v1n2p45

Samson A, Yackley AJ. Turkish stocks soar as local investors seek refuge from blistering inflation. Financial Times. 2022.

Siswara D, Effendi J, Muthoharroh M. The Integration of Islamic Stock Markets of OIC Countries in China Stock Market Crisis and US-China Trade War. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah. 2021;13(1):1-16. https://doi.org/10.15408/aiq.v13i1.20820

Surugiu MR, Surugiu C. International Trade, Globalization and Economic Interdependence between European Countries: Implications for Businesses and Marketing Framework. Procedia Economics and Finance. 2015;32:131-138. https://doi.org/10.1016/S2212-5671(15)01374-X

Susetio W, Jaya I, Kayagiswara G, Azis RA, Hikmawati E. Perang Rusia-Ukraina: Mencari Keseimbangan Baru. Jurnal Pengabdian Masyarakat. 2022;8(5).

Tiwang RA, Karamoy H, Maramis JB, Riadiani. Analisis Integrasi Pasar Modal Indonesia dengan Pasar Modal Global (NYSE, SSE, LSE, DAN PSE). JMBI Unsrat Jurnal Ilmiah Manajemen Bisnis Dan Inovasi Universitas Sam Ratulangi. 2020;7(3). https://doi.org/10.35794/jmbi.v7i3.31442

Copyright (c) 2023 Daffa Aqomal Haq, Asep Nurhalim, Ranti Wiliasih

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.