FAKTOR-FAKTOR YANG MEMENGARUHI TINGKAT PENYALURAN KREDIT PADA BPR KONVENSIONAL DI INDONESIA

Abstract

The global financial crisis has affected the banking condition in Indonesia, and the impact of this financial crisis has disturbed the banking financial performance. Bank Perkreditan Rakyat is a bank which specializes in serving the middle-lower community levels especially the micro, small and middle scaled entrepreneurships in meeting their capital through the procedures of cheap loan provision and simple loan mechanism. The objective of the research is to analyze factors influencing the level of loan distribution at BPR, and the factors include the variables of the third party fund, Non-Performing Loan (NPL), loan interest, Loan to Deposit Ratio (LDR), Operational Cost on Operational Income (OCOI), and Return on Assets (ROA).The secondary data collection in this research included data time series. The analysis methods used were the descriptive analysis and double linier regression using Minitab 17. The result showed that the variables of the third party fund, and Loan to Deposit Ratio (LDR) had a significantly positive influence on the loan distribution rate. The variables of NPL, loan interest rate, and OCOI had a significantly negative influence on loan distribution rate whereas the variable of ROA was not significantly influential toward the load distribution rate. The most important factor that needs to take into account in increasing bank loan distribution is offering a competitive interest rate.Keywords: DPK, NPL, loan interest rate, LDR, OCOI, ROA, loan distribution/disbursement

Downloads

Published

2016-05-14

How to Cite

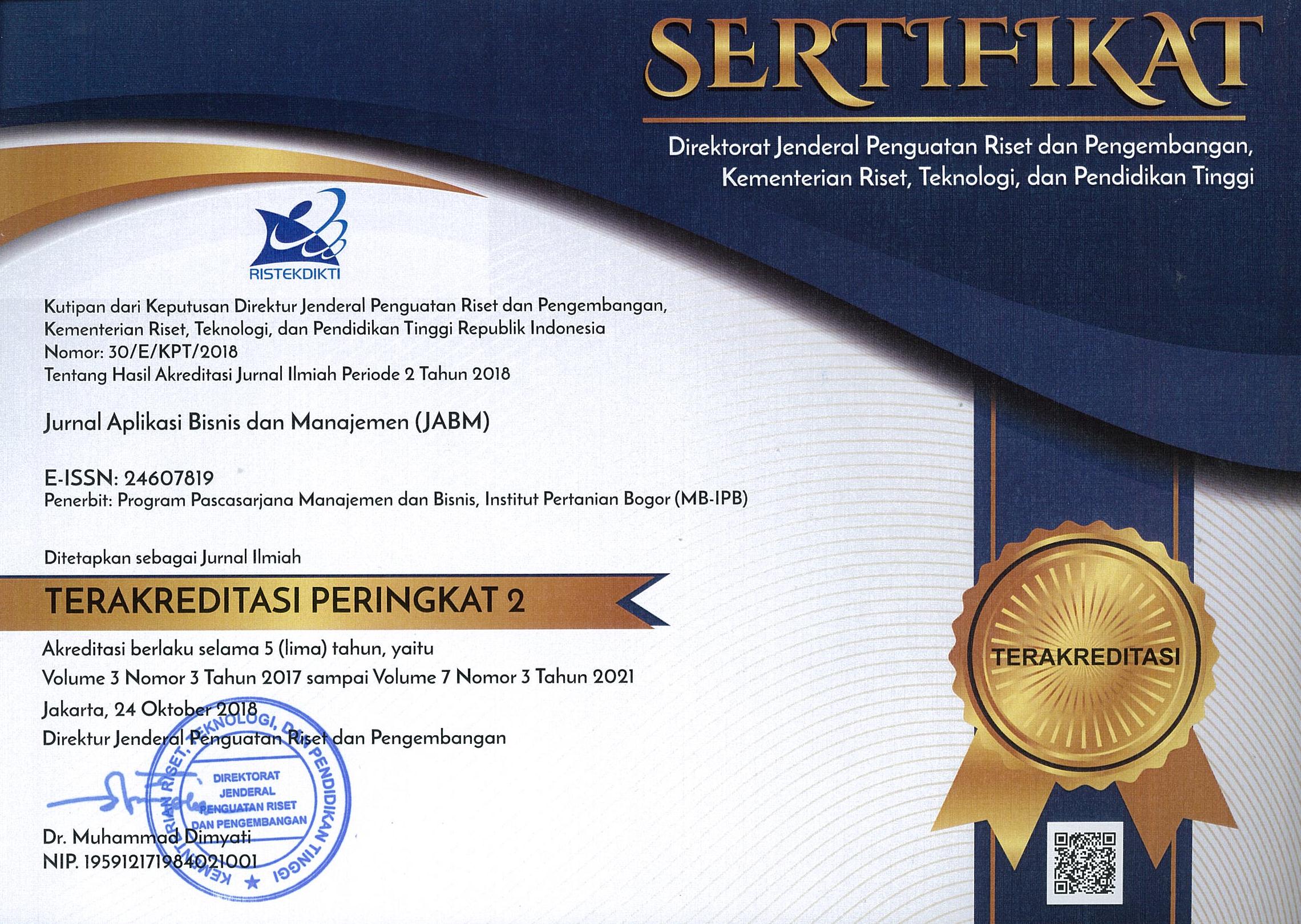

PurbaN. N., SyaukatY., & MaulanaT. N. A. (2016). FAKTOR-FAKTOR YANG MEMENGARUHI TINGKAT PENYALURAN KREDIT PADA BPR KONVENSIONAL DI INDONESIA. Jurnal Aplikasi Bisnis Dan Manajemen (JABM), 2(2), 105. https://doi.org/10.17358/jabm.2.2.105

Section

Articles