DETERMINAN FDI INDUSTRI HULU MIGAS DI INDONESIA SERTA DAMPAKNYA PERIODE TAHUN 2003–2013

Abstract

The inclusion of Indonesia as a net importer of oil, gas and high energy expenditure compared with oil and gas revenues is because of the lack of investment in upstream oil and gas in Indonesia. Indonesian oil and gas potential is relatively large, especially within eastern Indonesia. Taking into the account of the financial condition, risk and technological capabilities, the state still needs FDI to increase the upstream oil and gas operations in Indonesia. This study examined the FDI determinants by using panel data regression from 2003 until 2013 with a cross section of 82 mining areas. In addition, this study also analyzed the impact of FDI on energy security (proxy production) and state revenues, then compared them with domestic direct investment (DDI) represented by the state. Based on the data regression panel results, the variables which have positive influences on FDI were infrastructure, technology, education, corruption free index, raw oil price, oil and gas reservation, and BPMIGAS dispersion. Meanwhile, variables which hold negative influences were the market size, inflation, and economical openness. FDI holds positive impact on the state production and revenue level, nevertheless, from the production side, DDI gave bigger impact compared to FDI.Keywords: determinants, impact, FDI upstream oil and gas industry, and panel data

Downloads

Published

2016-01-25

How to Cite

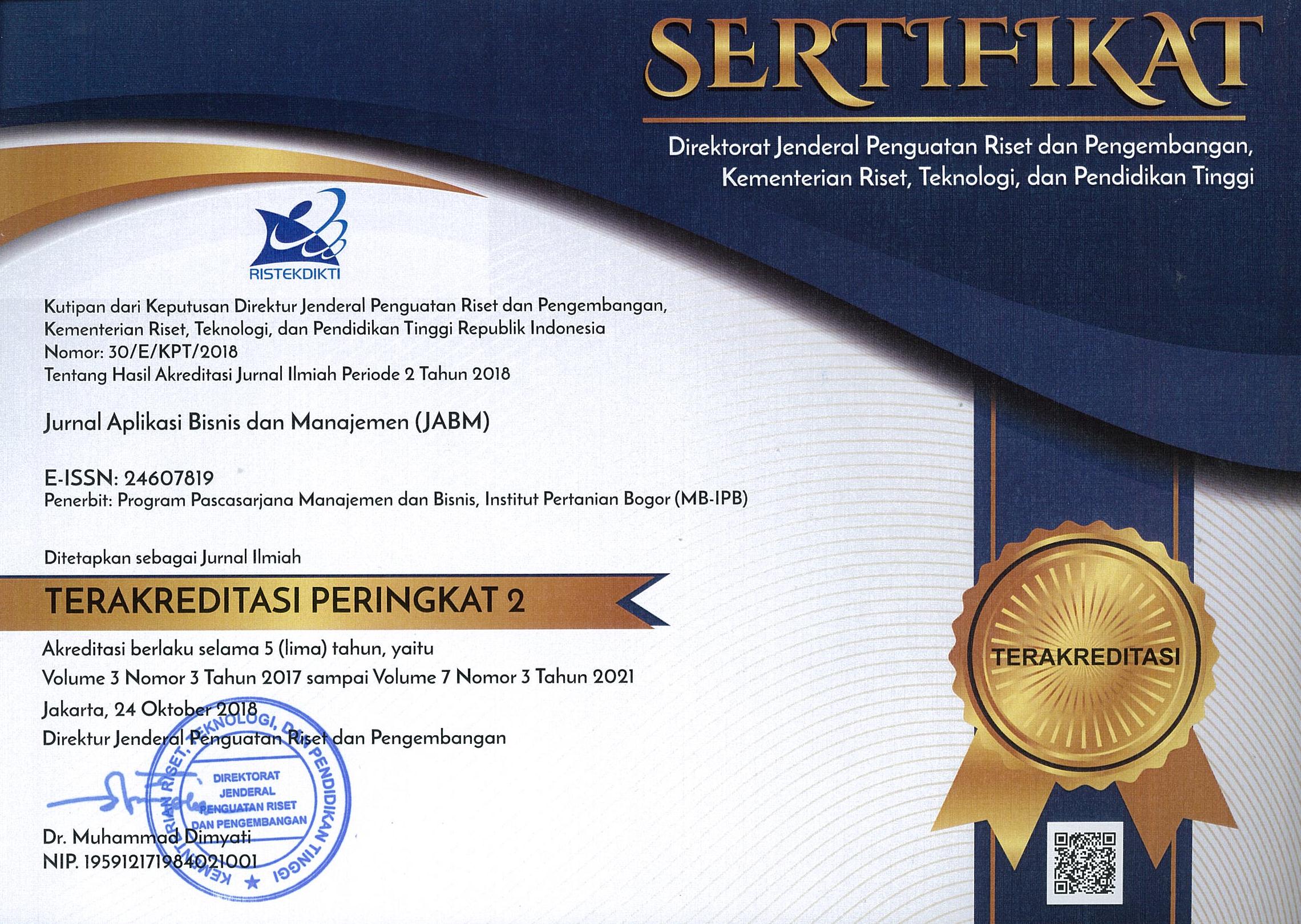

IskandarY., JuandaB., & JohanS. (2016). DETERMINAN FDI INDUSTRI HULU MIGAS DI INDONESIA SERTA DAMPAKNYA PERIODE TAHUN 2003–2013. Jurnal Aplikasi Bisnis Dan Manajemen (JABM), 2(1), 53. https://doi.org/10.17358/jabm.2.1.53

Section

Articles